Key Findings

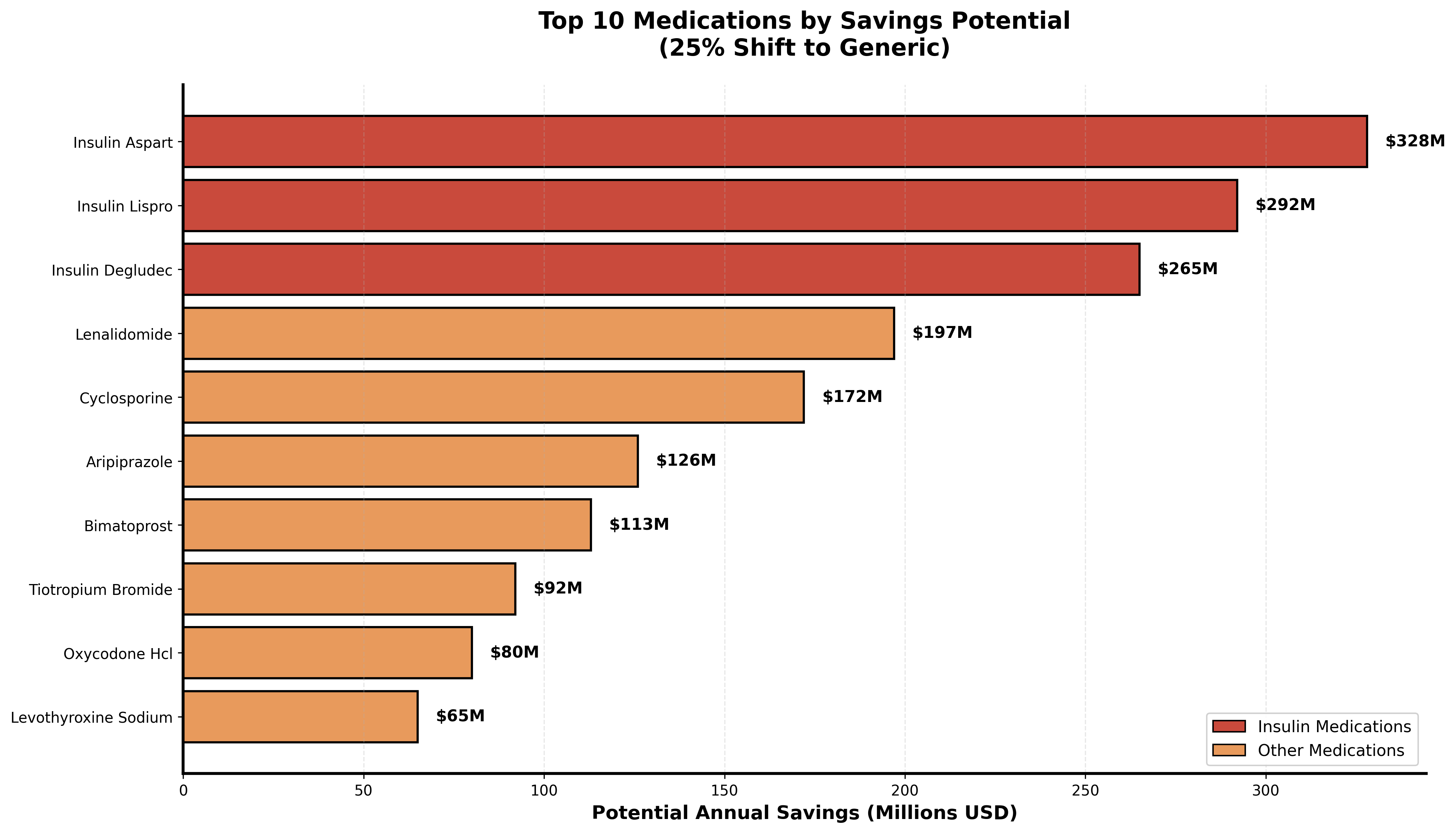

Three Insulin Products Represent $885 Million in Potential Savings

Insulin Aspart, Insulin Lispro, and Insulin Degludec showed 95 to 99% brand utilization despite available generics. These three medications alone represent the single largest savings opportunity in Medicare Part D.

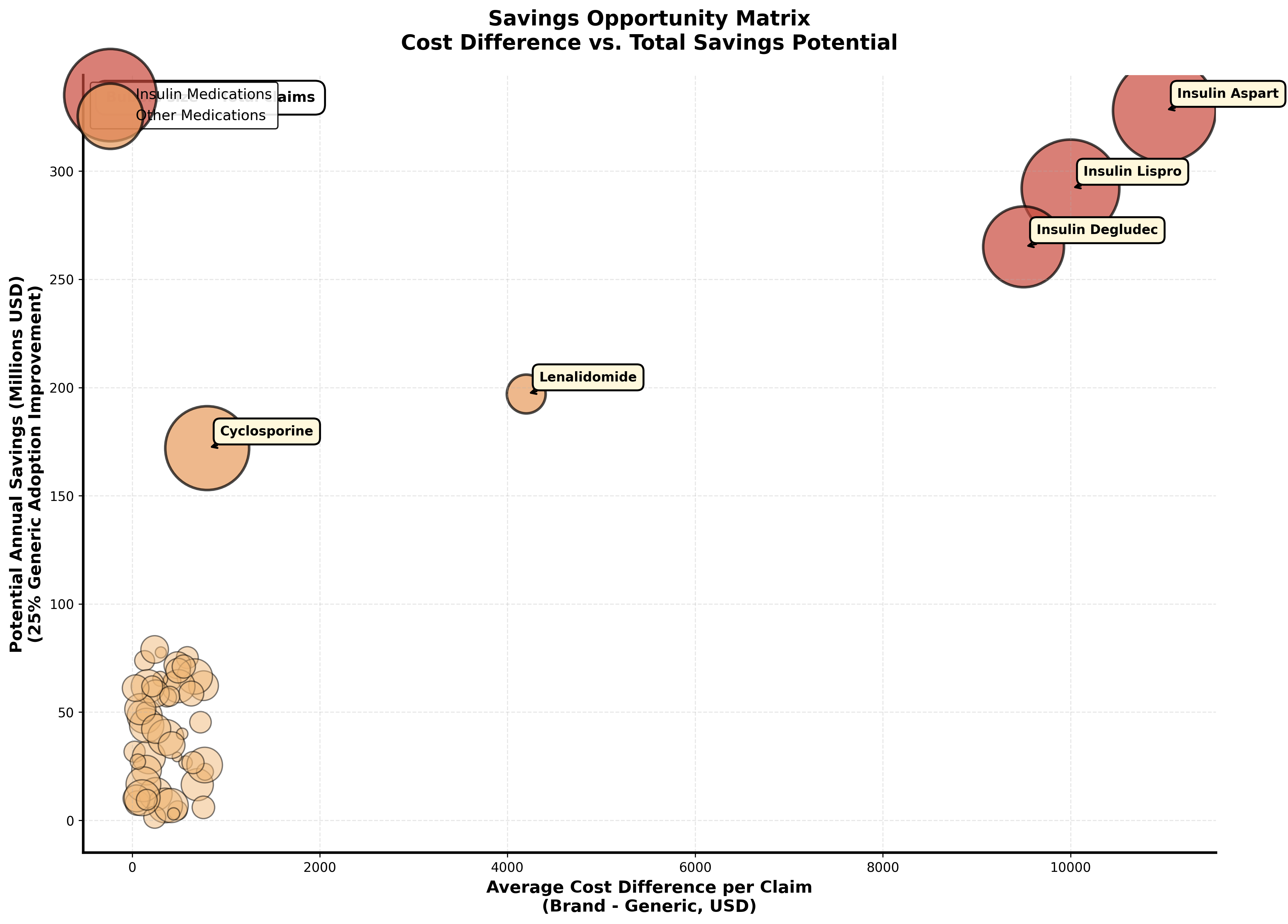

Top 10 medications ranked by potential annual savings with 25% generic adoption improvement

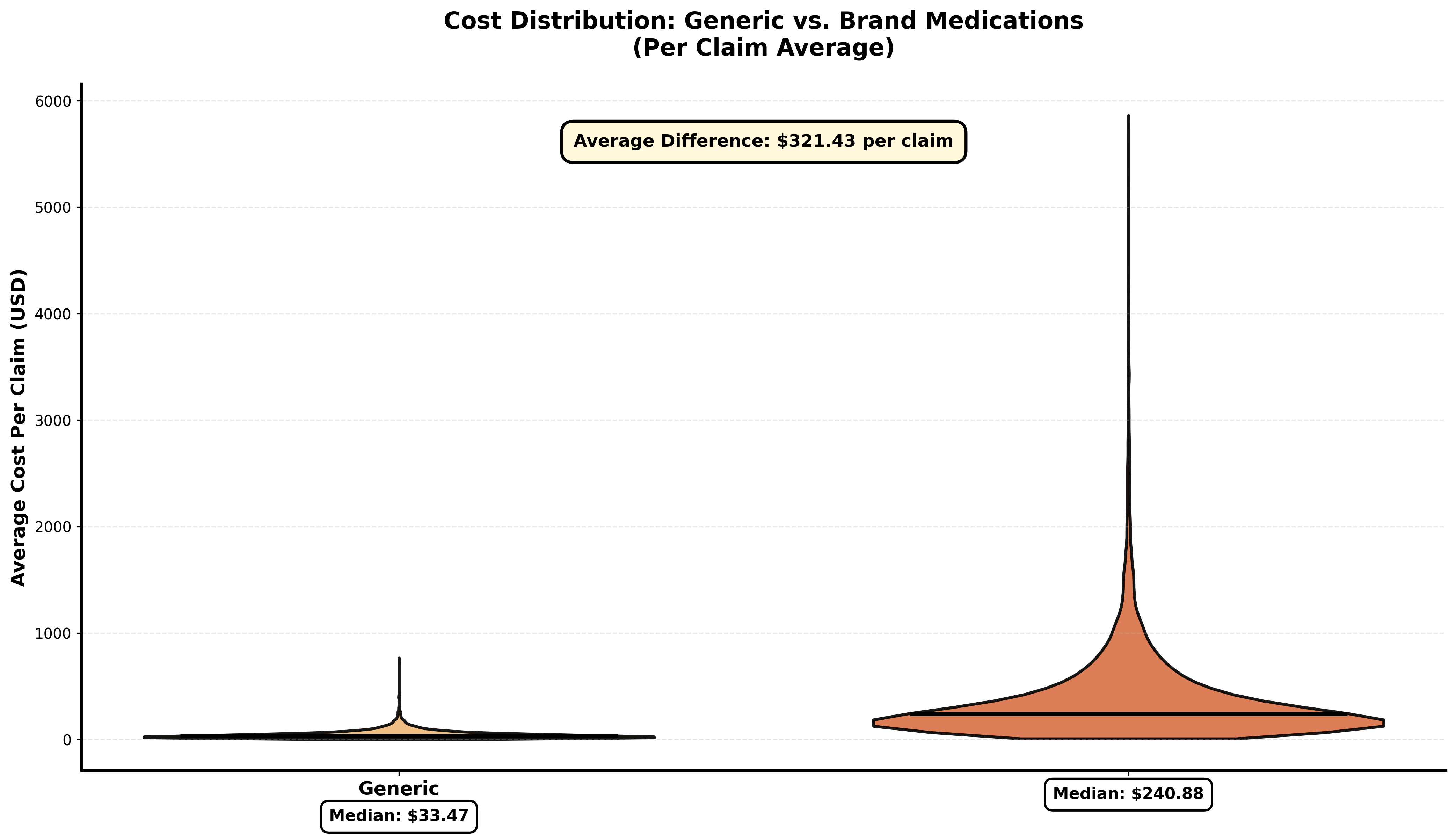

Distribution shows brand medications cost significantly more per claim than generics

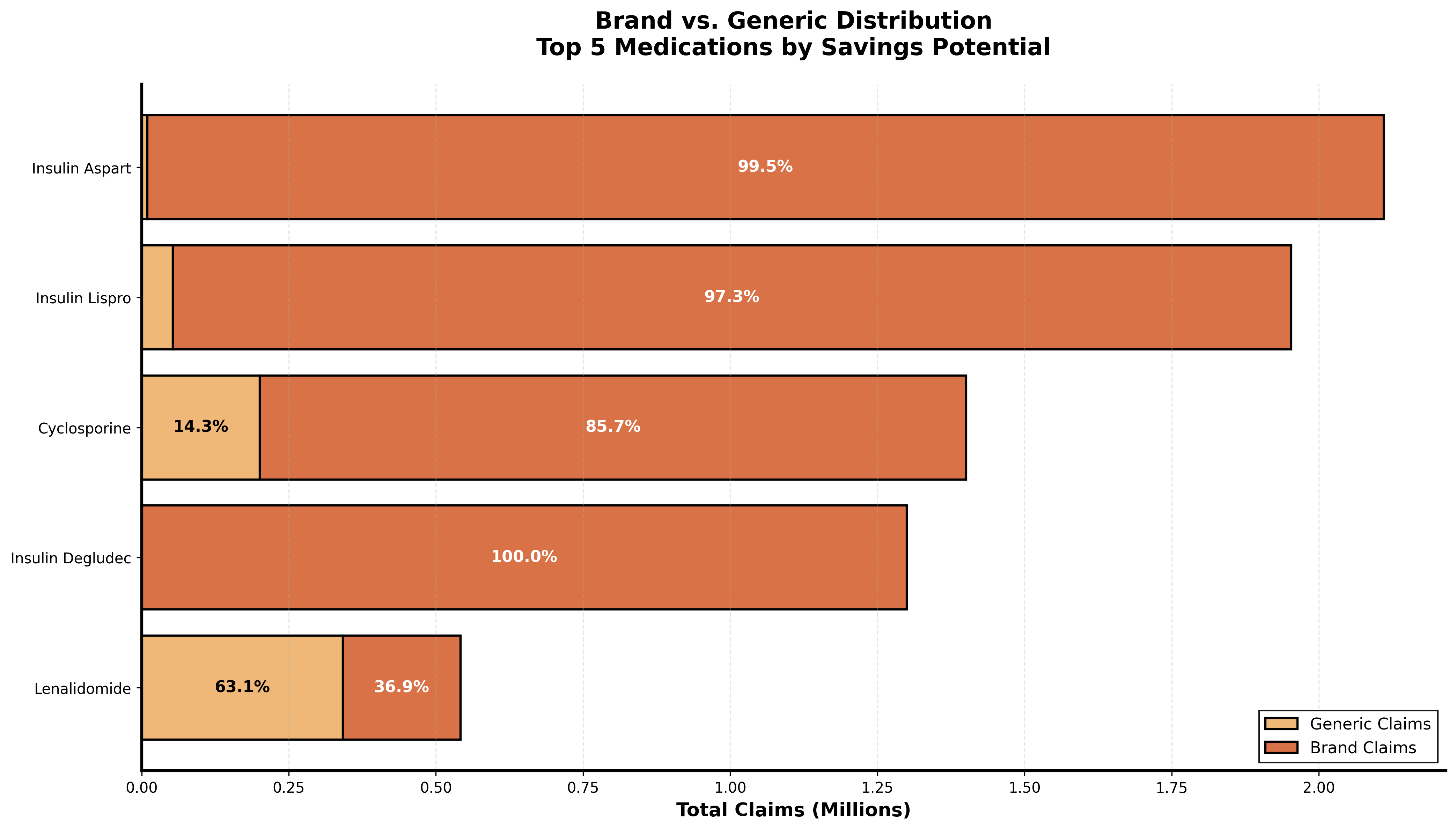

Stacked bars reveal insulin's 99% brand usage compared to better generic adoption in other drug classes

Each medication plotted by cost difference and savings potential. Insulin products cluster in the high impact quadrant.

Brand Dominance in High Cost Medications is Extreme

When visualizing the composition of prescriptions for top savings potential drugs, a clear pattern emerges. Insulin products show nearly complete brand dominance while other medication classes demonstrate that high generic adoption is achievable.

This isn't about generic availability. The medications exist. This is about systemic barriers preventing their use.

Your State Determines Your Generic Access

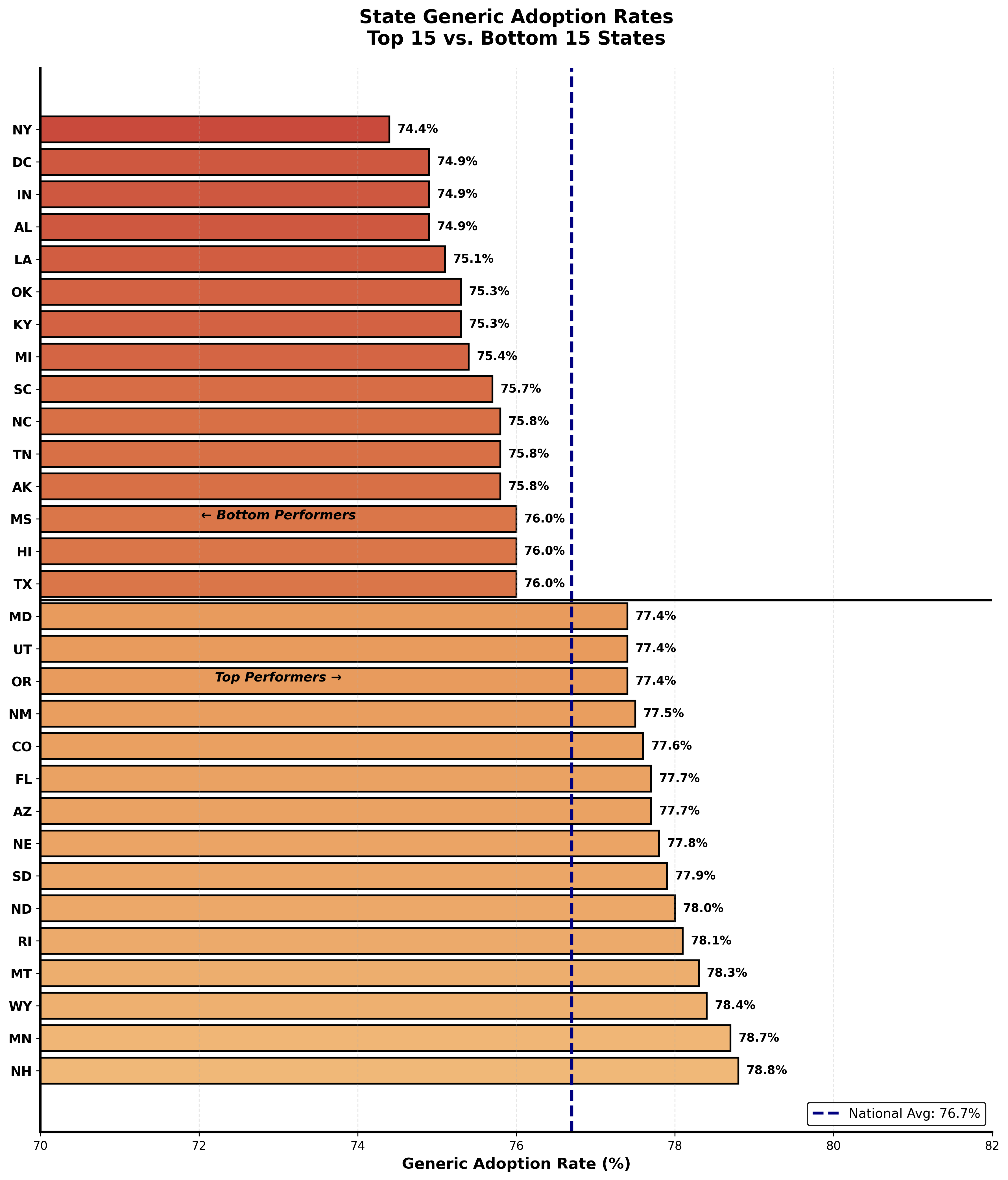

Generic adoption rates range from 69.7% to over 81% depending on location. This 11 percentage point spread translates to hundreds of millions in unnecessary costs and suggests the problem isn't medical necessity but regional prescribing patterns.

Top 15 and bottom 15 states by generic adoption rate. Geographic disparities are significant.

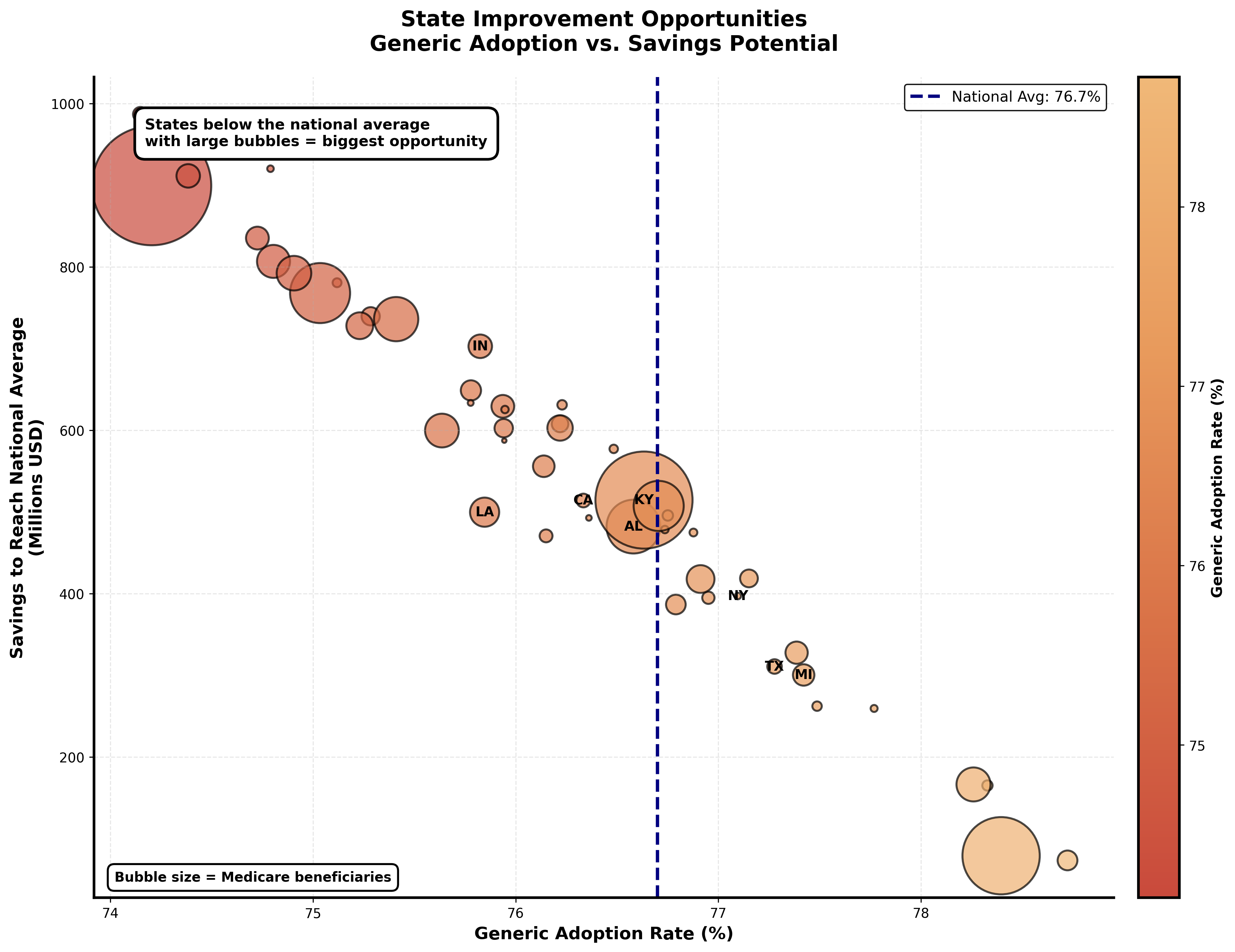

States plotted by generic adoption and savings potential. Large bubbles below the national average represent the biggest opportunities.

Five States Represent Over $2 Billion in Savings Opportunity

New York alone could save nearly $1 billion annually just by reaching the national average generic adoption rate. When combined with Indiana, Louisiana, California, and Kentucky, these five states represent massive concentrated opportunities for targeted intervention.

Systemic Friction, Not Clinical Necessity, Drives Brand Use

From behind the pharmacy counter, I see the real barriers. When a prescription comes through for a brand name medication and I see a generic alternative, I can't just switch it. I need prescriber authorization. So I call the doctor's office.

Sometimes the medical assistant says "generic is fine" and we make the switch. Sometimes the doctor wants brand specifically. But often the response is "that's just what the doctor always writes." Or they don't return my call. The patient needs their medication now, so we fill the brand because that's what's on the prescription.

Multiply this by millions of prescriptions nationwide and you see how systemic friction, not clinical necessity, drives brand utilization.